New laws in NSW have come into effect from January 1st 2016, in an attempt to prevent selling agents from price underquoting. This practice has been blamed for causing many consumers much disappointment, when the house of their dreams sells for far more than they hoped it would.

There are traditionally certain times of the year when property open for inspections are teeming with buyers, when everyone seems to be in a positive buying mood, and securing your ideal property at a reasonable price seems totally out of reach.

Early spring is one of these times, when buyers seem to come out of winter hibernation, and properties flood with natural light, and gardens come into bloom.

One of the common questions clients ask when seeking property investment advice is, ‘Should I buy a house or an apartment?’

Many novice investors are under the impression that houses make a better investment because they’ve read or heard that the land component of property increases in value, while the building depreciates over time.

Hence, they make the assumption that more land equals more bang for buck.

But that’s only half the picture, and a dated concept.

Let me explain – firstly not all land is created equal and it’s a misguided notion that it’s the size of the land that matters. What’s more important is the location and scarcity.

So where should I buy?

This is the first question you should ask yourself, before you even start to think about what type of property would be the most beneficial for your portfolio.

It’s an old cliché but ‘location is key’, it always has been and always will be. There are smart pieces of technology that you can use to help determine the walkability of a location. Walkability is the new buzzword in property circles, with many looking for locations that offer all the necessary leisure, shopping and work opportunities right on your doorstep.

The Sydney property market is currently undergoing a change in the cycle, and buying techniques and strategies that were necessary up until very recently, should definitely be reviewed.

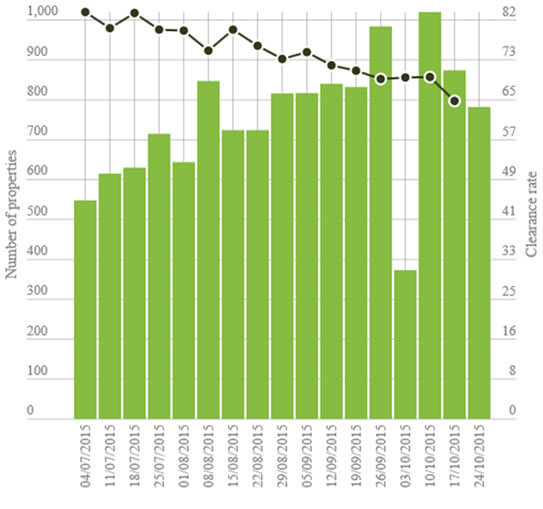

No longer are we seeing Auction clearance rates in the high 80% range, last weekend saw clearance rates down to 65%. Some lenders are getting more discerning on who, and how much they are lending to. Property volumes are currently also very high, adding to the choice current buyers have.

So how should your buying strategy change? And what is in store next for the property market?

Firstly, let’s make it clear that the blue chip areas of Sydney, which are the Eastern Suburbs, the Lower North Shore and the Inner West are still very healthy, and quality properties with all the desirable attributes are still attracting multiple buyers and bidding is still generally strong. There is no sign of a ‘crash’ or ‘bubble bursting’, and waiting for such is unrealistic.

However recent property buyers’ eagerness to buy at any price level, and the ‘fear of missing out’ is fading away fast. This is a good thing, as a healthy market is when there is a balance between the position of the buyer and the seller.