The Sydney property market is currently undergoing a change in the cycle, and buying techniques and strategies that were necessary up until very recently, should definitely be reviewed.

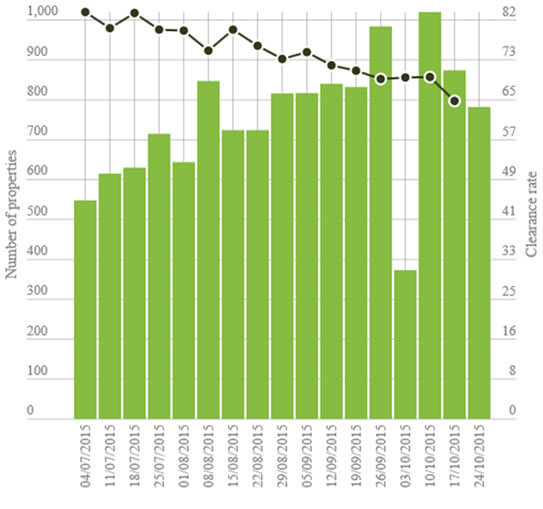

No longer are we seeing Auction clearance rates in the high 80% range, last weekend saw clearance rates down to 65%. Some lenders are getting more discerning on who, and how much they are lending to. Property volumes are currently also very high, adding to the choice current buyers have.

So how should your buying strategy change? And what is in store next for the property market?

Firstly, let’s make it clear that the blue chip areas of Sydney, which are the Eastern Suburbs, the Lower North Shore and the Inner West are still very healthy, and quality properties with all the desirable attributes are still attracting multiple buyers and bidding is still generally strong. There is no sign of a ‘crash’ or ‘bubble bursting’, and waiting for such is unrealistic.

However recent property buyers’ eagerness to buy at any price level, and the ‘fear of missing out’ is fading away fast. This is a good thing, as a healthy market is when there is a balance between the position of the buyer and the seller.

There have also been recent changes to the Property Stock and Business Act, designed to stop the common practice of underquoting. (Don’t expect anything too much to change here, unfortunately) Agents will still be able to misguide buyers, and the actual reason this is possible is that they prey on the fact that most buyers don’t know or fully understand how to accurately determine the true logical value for a property, so buyers are exposed to the selling agent (mis)leading them.

Over the past 18 months, buyers needed to be quite aggressive with their buying strategies, and often present very strong offers, on signed sales contracts, in order to secure a property. Agents rarely returned calls to buyers, and generally didn’t show much respect to buyers, as they knew the property would easily sell, and for more than the vendor wanted.

Recent market changes have caught many vendors off guard, and are now having to consider selling at a price level lower than what they had expected. Buyers now have increased negotiating power, and experienced buyers are using this to their advantage.

Knowing how to start the negotiation process, how much you should offer, and how much you should counter offer are all very critical. Often knowing how long and when to wait before making these offers are proving profitable as the selling agent has to now suddenly work much harder to put a deal together.

Good selling agents are highly skilled at playing one buyer off against another to achieve the highest price. Using this tactic in reverse, skilled buyers are playing one property and selling agent off against another, to get the best deal they can also. There are even some opportunities now, which are proving beneficial to the buyer to actually wait until auction day, to enter hard negotiations post auction.

The market adjustment is even catching selling agents off guard, with increasing numbers of properties having pricing adjustments in a downward direction approaching auction, rather than the common upward direction we generally see in a hot market.

Now, more than ever, it is critical to make sure you are aware of everything that is on the market in the area and price bracket you are searching. Make sure you physically inspect them all, and are ready to ‘educate’ the selling agent on this information as part of your negotiation. It is always hard work to cover all this, but the hard work and research should pay off in a better purchase result.

Good luck and happy house hunting!

Written by Frank Russo, Managing director of Search.Find.Invest Buyers Agency.