Market analysists predicated in late 2018 that Sydney property would drop by 30% - 40%, early 2019 saw the market flatten from price drops of approximately 10% in 2018.

Market analysists predicated in late 2018 that Sydney property would drop by 30% - 40%, early 2019 saw the market flatten from price drops of approximately 10% in 2018.

Since the federal election we have seen confidence return to the market.

A combination of maintaining capital gains tax discount and negative gearing, along with RBA rate cuts and some relaxation in lending standards by APRA has resulted in a positive result in the market.

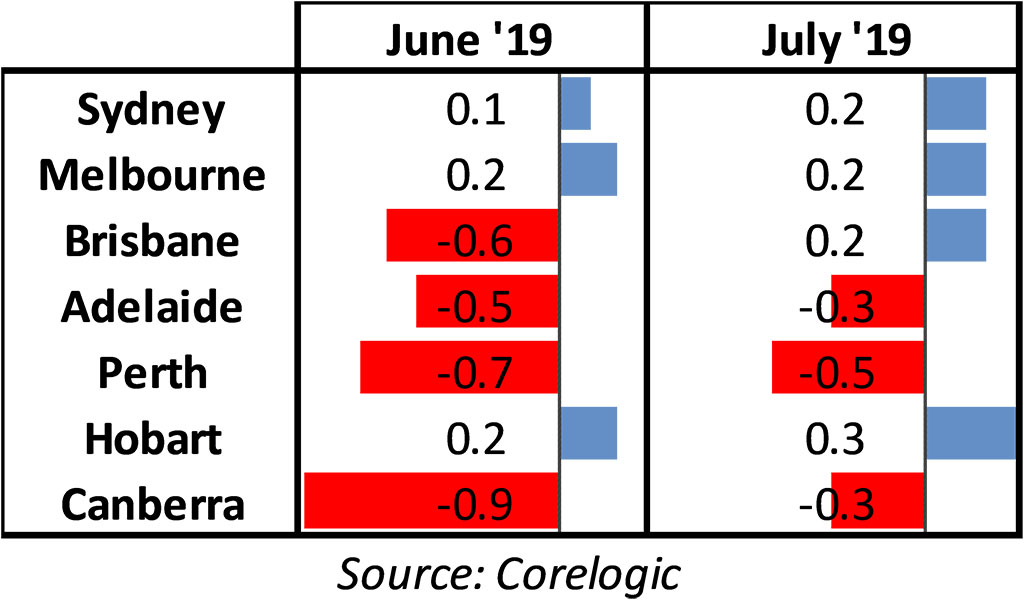

According to RP Data, both June and July saw modest price gains and despite relatively low sales volume, Sydney Auction clearance rates are strong, 78 per cent (as of 19th Aug ’19).

Predictions indicate that Sydney property prices could rise as much as 10% in the next year as analysis suggests price growth follows strong growing auction clearance rates.

Although economic factors are likely to cap growth in some suburbs. Household debt continues to be high, higher than the last time house prices took off and as unemployment is at risk of rising if the economy continues to deteriorate, property market growth will ultimately be limited in some areas, particularly if unemployment reaches unexpected levels.

Core logic has been tracking stock volume since 2007, and we are currently seeing the lowest volumes on record. It’s widely anticipated that this spring, stock levels will remain at record lows.

It seems that while vendors are confident that prices are rebounding they will continue to hold off selling, creating further upward price pressure.

Home Price Index

For more information on Sydney’s property market and how to purchase property in today’s conditions to achieve your personal and financial goals, speak to our property expert Frank Russo ph. 1300 132 970