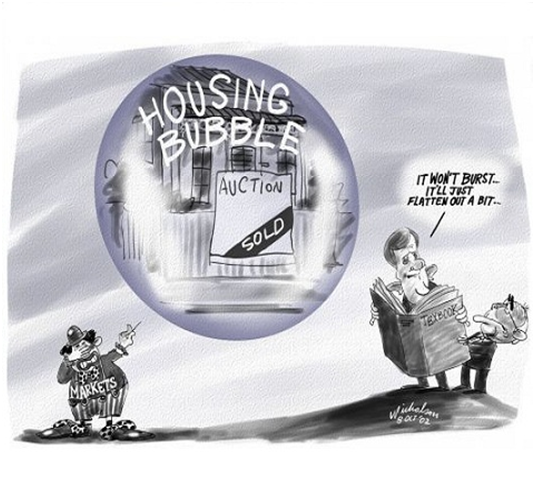

As you can see from this cartoon from October 2002, they have been talking about the housing bubble since John Howard and Peter Costello ran the country. Actually long before then.

So how have things progressed since?

Would you have liked to have bought a property at 2002 prices?

In 2002, a two bedroom North Randwick unit with a garage and a balcony,in a nice street would have set you back about $430,000 (source RPData)

That same unit today would give you very little change from $1,000,000.

If you look at the data for houses, a modest three bedroom freestanding bungalow on 430m2 of land in Waverley would have cost $1,000,000 back in 2002, which seemed like crazy money back then.

That same modest house will now sell for high $2’s, maybe even $3m, depending on its condition.

What about this next headline?

This was from the Sydney Morning Herald on Saturday, August 22, 1981.

Back in 1981, a unit from the previous example that is now worth close to $1m, would have cost you approximately $65,000 (source RPData)

We have had countless economic disasters during this time also. Global Financial Crisis’s, Credit collapses, changes in laws (negative gearing was removed and then re-instated), stock market crashes, Recessions etc…

So what about the bubble now?

What bubble?

New research from BIS Shrapnel reveals that mortgage repayments are easier today than they were 26 years ago. Although Sydney’s median house price is more than 7 times higher, standard mortgage repayments require just over a third of household income compared to almost half in 1989. This is largely due to the record low interest rates.

These findings provide fresh insight into the current concerns about housing affordability and prove that whilst housing may be expensive, it is more affordable today than it has been in the past.

Whilst Sydney’s rising house prices may be concerning to first home buyers, we have to recognise that Sydney is now an international city. Like New York and London, certain parts of the city will always be unaffordable to all but overseas billionaires and the international jet set.

So my advice to anyone considering buying a property right now is:

If you would like to discuss purchasing a new home or investment property, please do not hesitate to contact 1300 132 970